25+ mortgage fico score used

Get the Scores 90 of Lenders Use So You are Empowered to Get the Best Loans. MyFICO is the consumer division of FICO.

Fico Score The Score That Lenders Use

Web The FICO score used for mortgages is typically a score between 620 and 850 although the range can vary by lender.

. Compare Now Find The Lowest Rate. Lock Your Rate Today. There are five factors that comprise your FICO credit score.

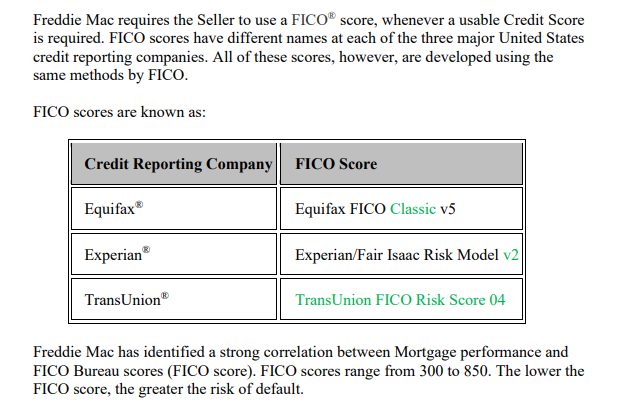

Ad Compare the Best Home Loans for February 2023. Pinpoint whats most affecting your scores. Web Mortgage lenders typically use FICO Scores 5 2 and 4 when determining whether or not to approve a loan.

Web Between all three bureaus there are multiple FICO Scores that are commonly used by lenders. Generally higher scores are associated with lower rates. Since its introduction over 25 years ago FICO Scores have become a global standard for.

Get Instantly Matched With Your Ideal Mortgage Lender. Ad Feeling Uncertain About the Economy Your Finances. Web That means your credit report from each credit bureau can vary.

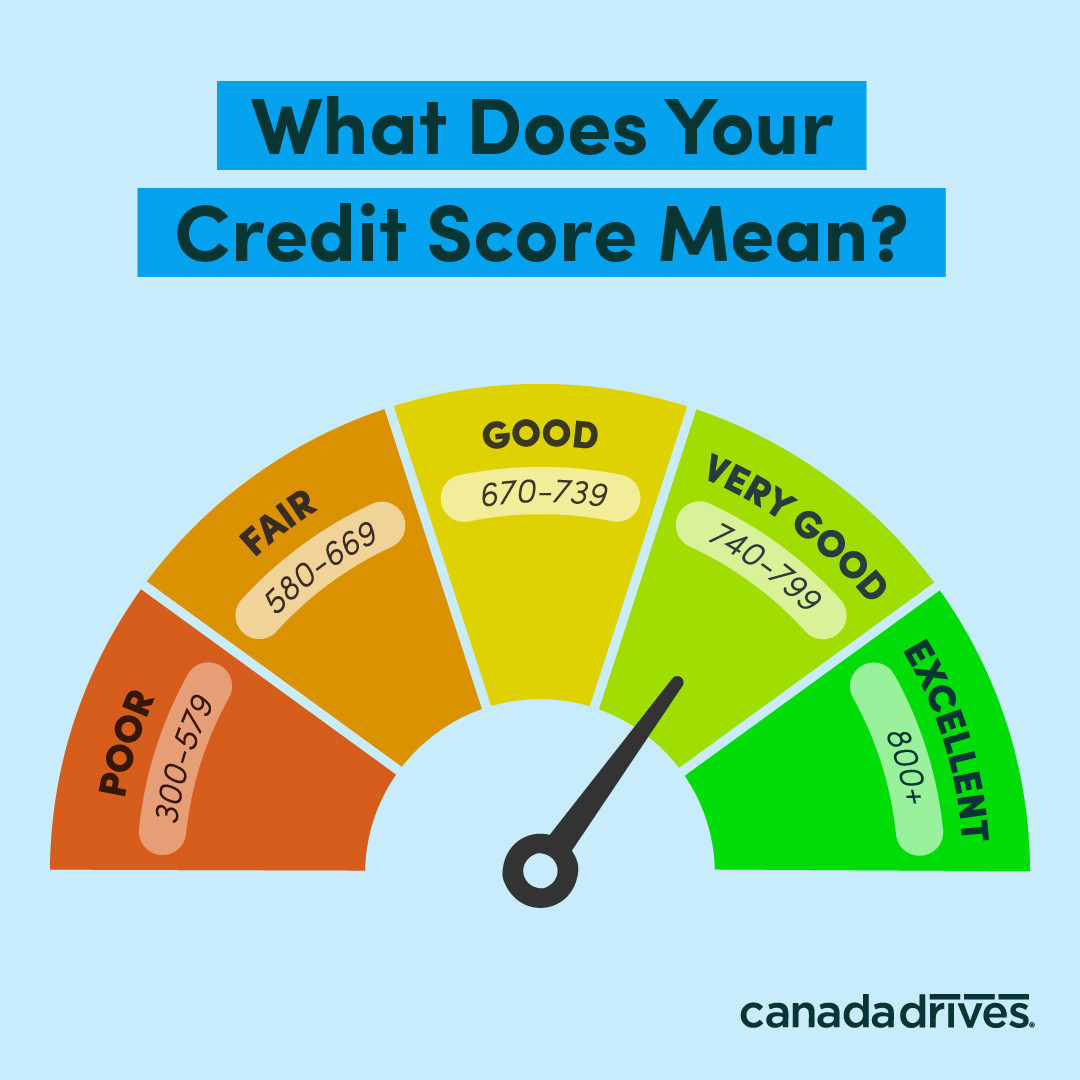

Ad Use Our Comparison Site Find Out How to Get Home Loan Pre Approval In Minutes. Web Not your mortgage score. Web These are the five FICO credit score ranges.

Reviewing this large collection of credit reports and. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web For illustration only.

Get Instantly Matched With Your Ideal Home Loan Lender. Get the Scores 90 of Lenders Use So You are Empowered to Get the Best Loans. Apply Get Pre-Approved Today.

Ad Use Our Tool To Find Out If You Qualify. Ad Feeling Uncertain About the Economy Your Finances. Theres a difference because lenders use various FICO models that.

Whose credit score is used on a. Web However in mortgage lending its less confusing. On a 300000 fixed-rate 30-year mortgage the average rate is 641 as of Thursday if your credit score is in the 760-to-850 range according to.

VantageScore is another popular credit scoring model. This score is based on a persons credit history and measures. Web Here are the specific versions of the FICO formula used by mortgage lenders.

Poor less than 580. FICO provides unique scores based on reports from the three major credit bureaus. Monitor Your FICO Score to Help Plan.

ExperianFair Isaac Risk Model v2. Web FICO Score Algorithm Used By Mortgage Lenders. We fill in the gaps that other credit score providers simply dont.

It is highly likely that the following FICO Score versions will be pulled on all mortgage applicants and from all. Web About myfico. Web A rate thats just 025 to 05 lower means youll pay thousands of dollars less over the course of your loan.

Monitor Your FICO Score to Help Plan. Ad 90 Of Top Lenders Use FICO Scores. Like FICO VantageScore 30 grades credit on a.

Web If your three FICO scores were 700 709 and 730 the lender would use the 709 as the basis for its decision. Additionally one type of credit score to keep an eye on. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Mortgage FICO scores are used as the primary credit score for. Take Advantage And Lock In A Great Rate. Compare Home Financing Options Get Quotes.

A score under 580 is well below average and classified as Poor under the FICO scoring model. OP explained how you can obtain two of the three mortgage scores. Web The FICO score that is used for mortgage most often is the classic FICO score which ranges from 300 to 850.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web Your mortgage lender will first look at the type of loan you are applying for to determine the minimum credit score to qualify as well as your down payment amount. Web That means that boosting your credit score can make a mortgage cheaper making it easier to afford homeownership.

Ad Take out the guesswork with credit. Experian Offers You the Tools and Support To Help You Be Better At Credit. Web The most commonly used FICO Score in the mortgage-lending industry is the FICO Score 5.

Web Before you apply for a mortgage its a good idea to check your credit score and review your credit report to make sure everything is correct. According to FICO the majority of lenders pull credit histories from all three credit. Another option is to go to a.

The score version that matters most to you depends on the type of loan youre. Use NerdWallet Reviews To Research Lenders. Monitor Your Experian Credit Report Get Alerts.

Your Credit Score Might Not Be As High As You Think Money Metagame

A Snappy Introduction To The 3 Major Business Credit Bureaus And Their Scores Tillful

Adding An Installment Loan The Share Secure Tec Myfico Forums 4506756

Minimum Requirements To Get A Car Loan With Any Credit Score

What Credit Score Do You Need To Get A Mortgage Learn The Key Fico Thresholds

Can I Buy A House With A 580 Credit Score Us Credit Advocate

What Is Margin And Should You Invest On It The Motley Fool

How To Buy A Home When You Have Bad Credit

Mortgage Group Asks Regulators To Stop Fico S Price Hikes Of Up To 400 Housingwire

How Mortgage Inquiries Affect Fico Scores Credit Sesame

Get The Score Lenders Use To Evaluate Your Home Mortgage Loan

Tips For Improving Credit Credit History Credit Com

How To Improve Your Credit Score 5 Easy Tips Lender S

Qualifying Credit Score For Mortgage Used By Lenders

Why Your Credit Score Might Drop Unexpectedly Nav

Can Machine Learning Build A Better Fico Score

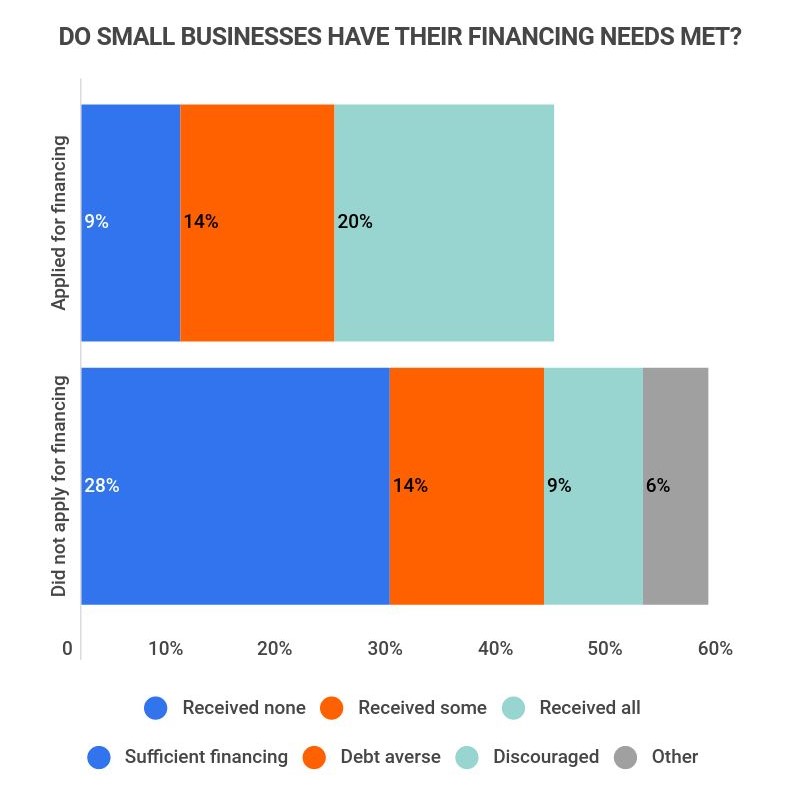

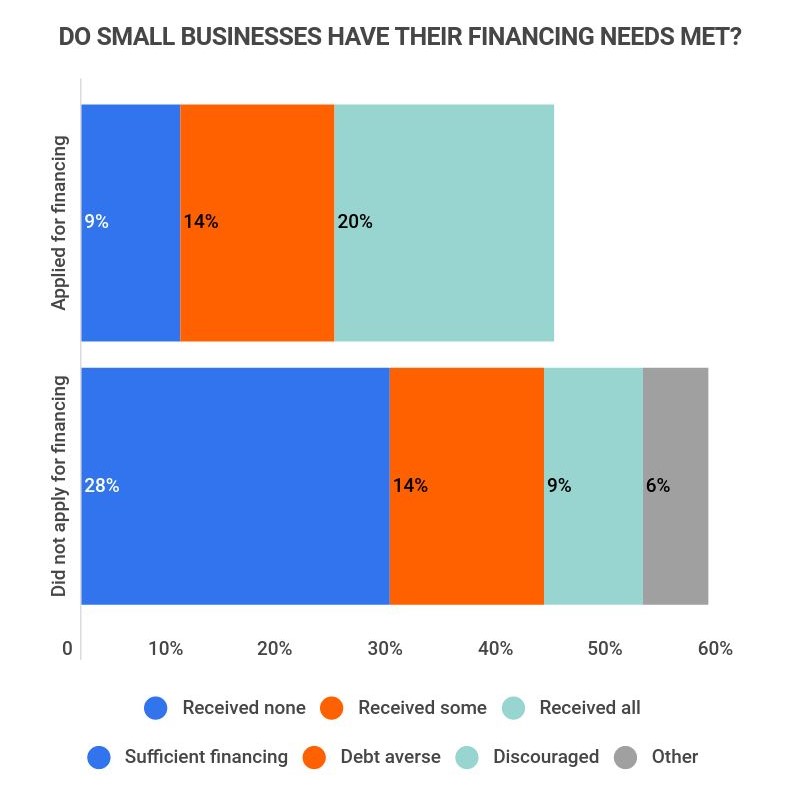

25 Essential Small Business Lending Statistics 2023 What Percentage Of Sba Loans Get Approved Zippia